Kibaki was known as a brilliant and gentlemanly economist who spoke authoritatively on national issues of the day like taming corruption and mismanagement of public corporations and his presidency changed the image of the country in the eyes of the international community.

Kibaki was known as a brilliant and gentlemanly economist who spoke authoritatively on national issues of the day like taming corruption and mismanagement of public corporations and his presidency changed the image of the country in the eyes of the international community.

During Mwai kibaki’s regime, Kenya kept away from a loan that is described as Inclusive Growth and Fiscal Management Development Policy Financing which is a type of credit where money flows straight into the budget to top up the public use.

But for the first time in years, Kenya has reached out to the World Bank for an urgent loan in the form of budget support.

In a letter to the world bank, Treasury CS Henry Rotich says that Kenya has sealed corruption loopholes and carried out lifestyle audits on all public servants. Mr Rotich says the government has taken up the fight against corruption by arresting and prosecuting government officials and business people involved in graft.

The proposed funding is, however, facing obstacles from some countries whose representatives on the bank’s board allege that in the context of weak financial public management systems and challenges, such as the one the government is faced with in trying to account for Eurobond proceeds, the type of loan is hardly suitable for Kenya.

The choice of development projects in the country has bogged down by the piling public debt which has made the Government change tack.

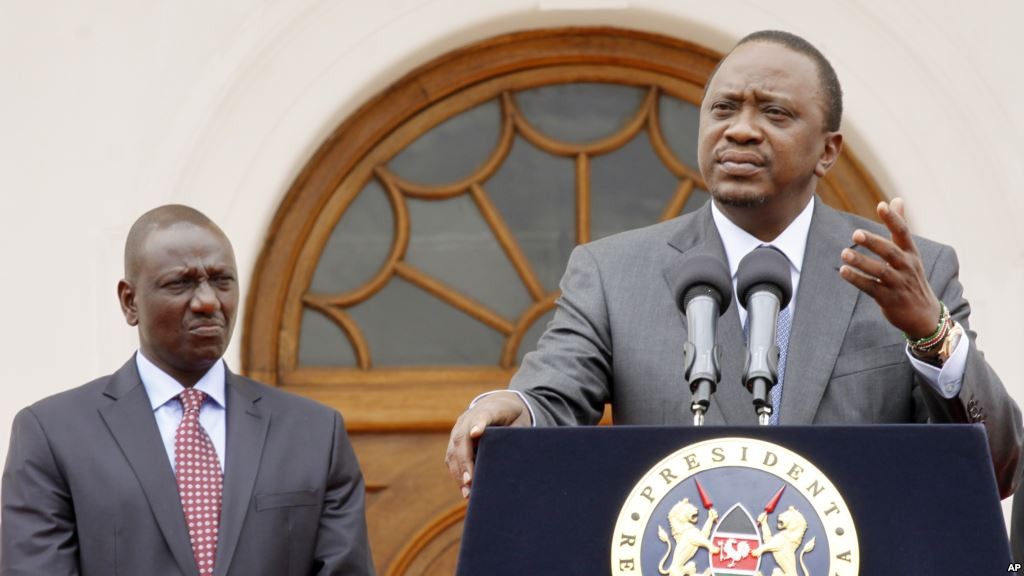

The Jubilee administration has set out to build a million units of public rental houses in the next five years in a bid to limit the number of informal settlements in the country and also to provide affordable housing to low-income earners.

Besides affordable housing, President Kenyatta has also set his eyes on ensuring food security, job creation and inexpensive healthcare in his final term.

Should the loan be approved, it will add to Kenya’s growing debt burden. The country’s debt position has reached a dangerous level, with experts warning that it poses a real and massive systemic risk.

“What we should be looking at is debt service-to-government revenues, and much less the GDP-to-debt ratio popular with our Treasury. We continue to justify the current situation where the Treasury prefers to use debt-to-GDP, hence arguing that we’re within the IMF benchmark sustainability ratios,” said an economist.