With the introduction of the 1.5% housing levy, Treasury was seeking to raise Sh57 billion annually from workers to finance the proposed National Housing Development Fund.

Market experts are not comfortable with the Ksh10,000 maximum fine or two-year imprisonment retained as a penalty for misappropriation of housing levy.

The penalties are not deterrent enough, says PricewaterhouseCoopers in its Tax Alert: The Housing Fund Regulations, 2019.

“The fine is unlikely to be an effective deterrent. We were hoping that the penalty clause would be enhanced to give confidence to members that their funds will be safe,” said PwC in the Tax Alert statement.

PwC has also questioned the clause that requires voluntary members to still make a monthly contribution of Ksh100 towards the Fund’s maintenance costs as it creates inequity as employees are not required to make a similar payment.

“This may discourage voluntary membership, especially in the informal sector,” added PwC.

Other contentious issues that have not been addressed are lack of clear “income” definition (whether it refers to basic salary only or whether it includes non-cash benefits as well), there are no specific tax incentives provided to employers, and succession framework

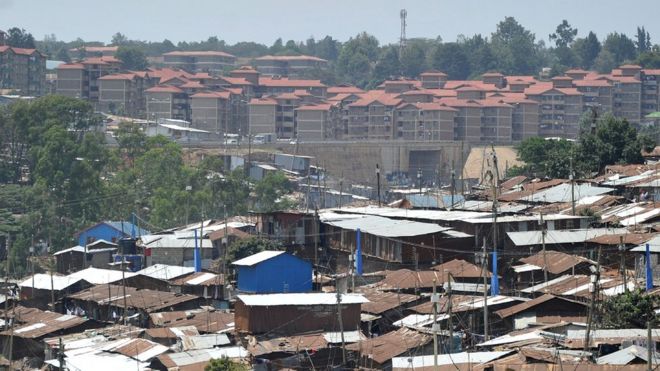

The 500,000 new housing units will be built under the program at a cost of Sh1.5 trillion but CS Macharia says local and international developers have expressed interest in putting up one million units.

Employers will risk paying hefty penalties for late remittance of monthly staff salary deductions and their own contributions towards the Jubilee government’s cheap housing fund.

Draft regulations indicate that late remittance will attract a five per cent penalty, putting in a tight spot struggling firms that have been delaying workers’ salaries and other statutory deductions such as pension savings due to cash flow challenges.

“If any contribution…is not paid within one month after the end of the month in which the last day of the contribution period to which it falls, a sum equal to five per cent of the amount of that contribution shall be added to the contribution for each month or part of a month that the amount due remains unpaid,” says the regulations.

This means that employers who run into financial challenges leading to delayed salaries will have to give priority to paying the levy on time at the expense of other monthly obligations or risk incurring penalties which could run into tens of millions of shillings for big companies.