Millions of time-constrained employees will no longer have to queue in long lines to beat the June 30 deadline set every year.

The Kenya Revenue Authority (KRA) provided relief for employed Kenyans as they will no longer have to undergo the process of keying in their tax returns on the iTax portal anymore.

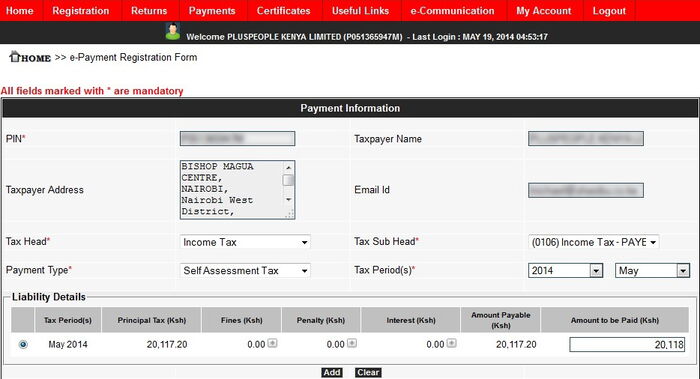

This after the KRA reconfigured their systems to automatically capture the data from employers who submit Pay As You Earn (PAYE) tax.

The taxman had on Friday issued a notice to suspend activity on the iTax portal to facilitate system maintenance.

A local paper reported that on January 16, Commissioner General John Njiraini stated: “Those of you who are employees, when your employer does PAYE declarations, that information comes with your PIN and iTax is able to pick it and place it in your account.”

“KRA has enhanced iTax to have an auto-populated return of employment income. This has made it much easier, smoother and faster for employees whose source of income is only employment,” a statement by the agency reads.

Employees have only been left with the task of reviewing and confirming data which they previously had to key into the system.

The affected taxpayers are therefore urged to ensure that the entries reflect a true and correct position for the tax period and report any inconsistencies.

For a long time, Kenyans had been wondering why the government required people to confirm payment of taxes whereas the authority itself could do it from the back end.

The agency urged employers to issue P9 forms early enough to facilitate employees to verify information captured by KRA.

Speaking to reporters, an officer stated that unemployed Kenyans and business owners will, however, still be required to fill nill returns and taxes for their businesses respectively.

Taxpayers who will miss the deadline will face a penalty of upto Ksh2,000 for individuals and Ksh10,000 or five percent of the tax due for other entities under the Tax Procedure Act, 2015.