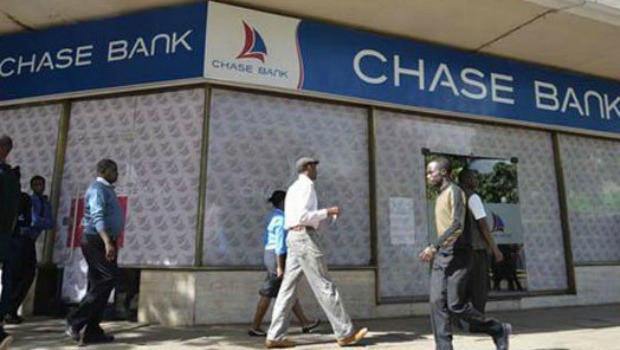

It was among the Kenya’s financial giants, but today, it is no more! Did you know that former Chase Bank Kenya chairman Zafrullah Khan awarded himself a three-year consultancy contract for unspecified projects in the bank, 16 months before it collapsed on April 7, 2016?

Well, a special audit report by Deloitte released a month after the CBK placed the bank into receivership shows the man at the centre of Sh14.9 billion internal bank heist was to earn $50,466 (Sh5.15 million) a month.

According to the Star, the Harvard educated money market honcho generously offered everyone he met, regardless of social economic status, a warm smile partly hidden in his signature moustache.

The energy in him must have started fizzling in March 2016 when the bank posted Sh742 million loss for the year ended December 31, 2015, compared a profit of Sh2.3 billion the previous year.

Khan and the bank’s group managing director were forced to step aside on April 6, 2016.

This development rekindled memories of Imperial Bank, another lender that had been placed under receivership almost six months earlier after a 13-year-old fraud orchestrated by a director was uncovered.

That evening, social media went berserk with rumours about Chase Bank collapsing, attracting panic withdrawals that saw CBK put the lender under one-year receivership the following day.

What followed was a vigorous forensic audit of the bank’s activities by Deloitte. And after 53 days, the verdict was out in May 2016: Khan had helped bank’s bosses loot Sh15 billion.

The report zeroed in on seven incidences that depict a bank robbery script from Hollywood only that in Chase Bank’s case, characters spilt no blood.

For instance, the bank operated two general ledger accounts: CBK Settlement account number 04005459002 worth Sh9, 222,606,805 and Sundry Debtors account number 100004715 worth Sh1, 453,589,511.

Although the two accounts worth Sh10.67 billion were initially classified as other assets in Chase Bank’s accounting records, they were later reclassified as loans and advances during the 2016 statutory audit.

Chase Bank’s former general manager Makarios Agumbi and his credit counterpart James Mwaura were responsible for initiating and approving transactions posted in the two accounts.

The two said Sh7.5 billion was used to buy 12 properties for the bank by related entities and Sh3.1 billion as sums unsupported by documentation.

However, a forensic audit revealed that only Sh1.3 billion of Sh7.5 billion spent on 12 properties can be ascertained and that Khan and Duncan Kabui, the Group Managing Director, owned shares in five companies that owned the properties.

The five includes Riverside Mew Limited that acquired Riverside office Block (Sh150 million), One Riverside apartment (Sh61.5 million), English Point Marina apartment (Sh70 million), three plots in Voi (Sh18 million) and Ukunda Mosque plot at Sh32.56 million.