January is one of the harshest and hardest months of every year for most people. Also known as Njaanuary, pockets run empty at this time with many opting for credit from shylocks and financial institutions.

This is where you can sort your financial needs in Njaanuary.

Mshwari

This product from Safaricom gives you an opportunity to save as little as Sh1 and earn interest of up to 6.65 percent yearly on your saving balance. This cash is moved into the savings account via M-PESA without any charges.

Mshwari allows you to access micro-credit product of a minimum of Sh100 with a maximum of Sh50,000 any time and receive your loan instantly on your M-PESA account charged at a facility fee of 7.5 percent.

Here, you can take a mobile loan for as little as Sh100 and pay your bills but if you fail to repay back before the required deadline, Safaricom may blacklist you hence you would not be able to access a much higher loan from a bank for a period that is as long as seven years.

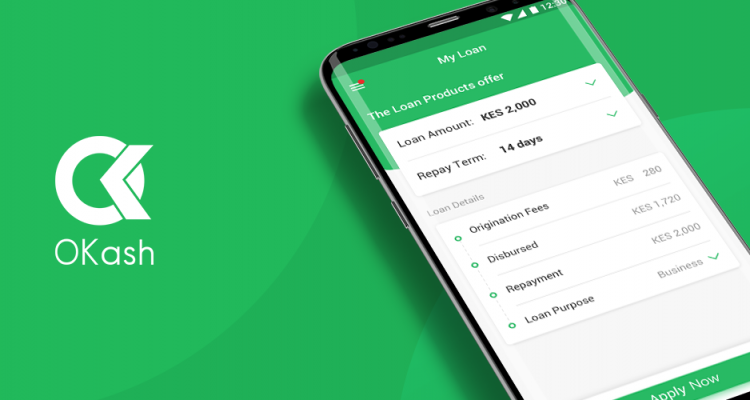

Opera software has launched Okash, a micro-loan mobile service app. As a Trustable Personal Loans Provider, OKash makes it easy for you to access credit anytime, anywhere.

You can borrow KES2,500~50,000 from OKash and receive the cash instantly via M-Pesa. Your loan limit will depend on your credit and repayment history. You can build your credit up to 50,000KSH by making loan payments on time!

As a peer to peer micro lending and borrowing platform, OKash will charge different facilitation fees according to the product you choose, which is used for credit score assessment, account management, and M-Pesa payment cost.

This product is limited to only Safaricom subscribers since it relies on M-Pesa to disburse loans.

OKash has a special offer for new customers, click for more.

Advance

If you are a permanent or temporary employee, you can make an arrangement with your employer to extend a salary advance to see you through the month of January.

In this case, your employer determines the percentage of the advance that is stretched out to you depending on whether the company is also experiencing Njaanuary or not.

It is your right hence, there is no interest rate.

Advantages of taking these credits

It is very Reliable and the Loan approval is instant. You can make partial payments thus You do not need people for security or collateral.