Safaricom has announced plans to take its M-Pesa overdraft service, Fuliza, to seven new African countries as the telco seeks to tap into the high demand for instant, micro-loans.

The telecommunications firm wants to introduce Fuliza in six other countries outside Kenya.

These include Tanzania, Lesotho, Ghana, the Democratic Republic of Congo (DRC) and Mozambique where Safaricom’s mobile money service M-Pesa is already available through its parent company, Vodacom.

M-Pesa services are also available in India through Vodacom.

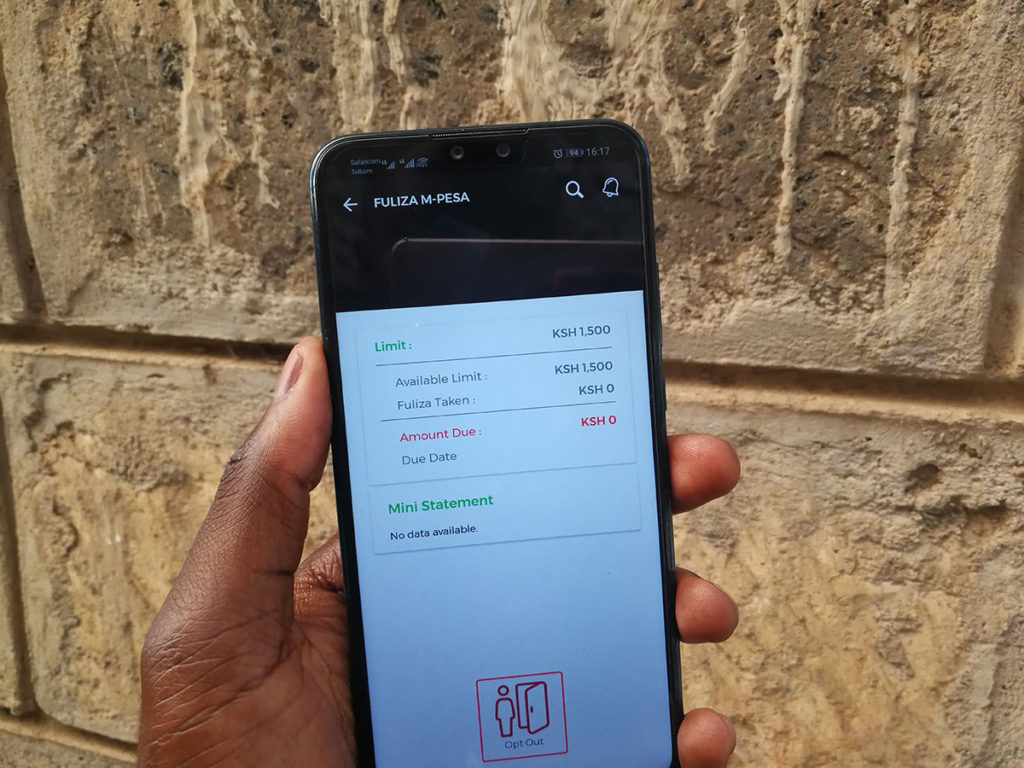

Fuliza, an overdraft facility that allows M-Pesa users to borrow small, short-term loans, was launched on January 5 through a partnership involving Safaricom, Commercial Bank of Africa (CBA) and KCB Group.

The banks provide M-Pesa users with top-up loans whenever they need to make a transaction, but find they lack enough money in their mobile cash wallets.

Borrowers in Kenya can take loans of up to Sh70,000 that can be used to buy goods or pay bills.

The money is also transferrable to other mobile subscribers.

“What we have also done with Fuliza is looked at it not just from a Kenyan perspective, but with our (parent) company Vodacom.

“There are seven countries in Africa that run M-Pesa and we’ll be looking into taking Fuliza to those markets first,” said Safaricom’s Chief Financial Services Officer Sitoyo Lopokoiyit in an update shared last week.

“It’s in line with the idea to take other products and services we have developed in Kenya into other markets.”

M-Pesa subscribers in Vodacom’s Tanzania, the DRC, Mozambique and Lesotho markets expanded by 227,000 customers in three months to hit 13.4 million users at the end of December last year, according to Vodacom.