With more than $1 billion in debt to China, Sri Lanka handed over a port to companies owned by the Chinese government. Now Djibouti, home to the US military’s main base in Africa, looks about to cede control of another key port to a Beijing-linked company, and the US is not happy about it.

With more than $1 billion in debt to China, Sri Lanka handed over a port to companies owned by the Chinese government. Now Djibouti, home to the US military’s main base in Africa, looks about to cede control of another key port to a Beijing-linked company, and the US is not happy about it.

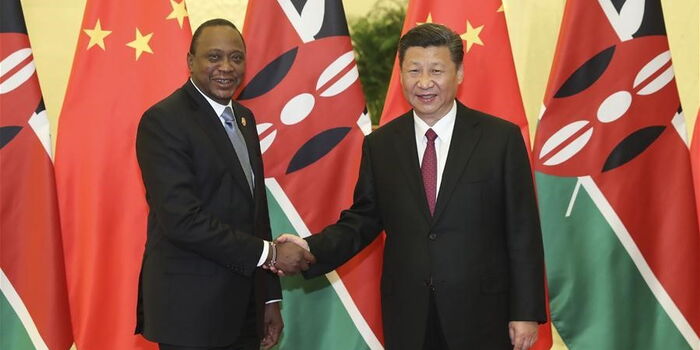

The signed SGR deal between Kenya and China suggests the risks go beyond the port, but also allows the Chinese lenders to take over other critical resources — anything from airports and natural resources to embassies abroad.

And according to the Nation, when they put the implications of this clause to Mr Rotich, the Treasury Cabinet Secretary gave a terse response: “Where did you get such information? Send me where you got it from. Not aware about such a thing [sic].”

This means Kenya’s key and strategic assets at home and abroad will not be protected by “sovereignty” and risk being seized by the Chinese government should there be a default in repaying the Standard Gauge Railway loan, a copy of the contract seen by the news rooms has revealed.

“Neither the borrower (Kenya) nor any of its assets is entitled to any right of immunity on the grounds of sovereignty or otherwise from arbitration, suit, execution or any other legal process with respect to its obligations under this Agreement, as the case may be in any jurisdiction,” Clause 5.5 of the Preferential Buyer Credit Loan Agreement on the Mombasa-Nairobi SGR reads.

The contract is signed by National Treasury Cabinet Secretary Henry Rotich and Mr Li Riogu, then-Chairman and President of the State-owned Export-Import (Exim) Bank of China.

In the deal, Kenya is also compelled to import goods, technology and services from China.

According to experts interviewed for this article, the blanket reference to “any asset” not only exposes the Kenya Ports Authority (KPA), whose leaked audit report last month raised questions about its vulnerability in case of default, but also allows the Chinese lenders to take over other critical resources — anything from airports and natural resources to embassies abroad.

The apparent exposure of Kenya’s assets gets even more curious given the clause that says the loan agreement would be “governed by and construed in accordance with the laws of China”.

The initial SGR loan agreement, signed slightly over one year after the Jubilee administration came to power, is also designed to be kept secret, as captured in clause 17.7 of the loan pact.

This raises questions on the Freedom of Information requirements by the Kenyan Constitution.

“The borrower (Kenya) shall keep all the terms and conditions hereunder or in connection with this agreement strictly confidential.

“Without the prior written consent of the lender (China), the borrower shall not disclose any information hereunder or in connection with this agreement to any third party unless required by applicable law,” the confidentiality clause reads.

But even more intriguing is the clause in the contract that says any disputes on the loan would only be resolved in Beijing through the China International Economic and Trade Arbitration Commission (Cietac).

“The arbitration award shall be final and binding on both parties. The arbitration shall take place in Beijing,” the agreement says, effectively blocking other international commercial dispute resolution avenues.

Kenya has further signed never to dispute the choice of Cietac as an arbitrator and to take its decision.

Mr Shah said although parties to a contract have the freedom to agree on which law would govern the agreement, China’s choice of the arbitrator and the specification that the arbitration would he held in Beijing is “suspect”.

“Normally, you would need an independent arbitrator, because this is about mediation, which should be made neutral and impartial by all means.

“Specifying the mediator and the unneutral ground to carry out the mediation is suspect. This can be challenged in law,” Mr Shah, who also practices in New York and London, told the Sunday Nation.

Is Kenya at risk of defaulting the loan and we end up loosing key assets?