The Kenya Revenue Authority (KRA) has threatened to deduct non-tax return penalties from the salaries of defaulters.

This has come after the Taxman failed to hit the target of four million Kenyans who filed their tax returns. Only 3.6 million filled the taxes leaving out about 400, 000 people.

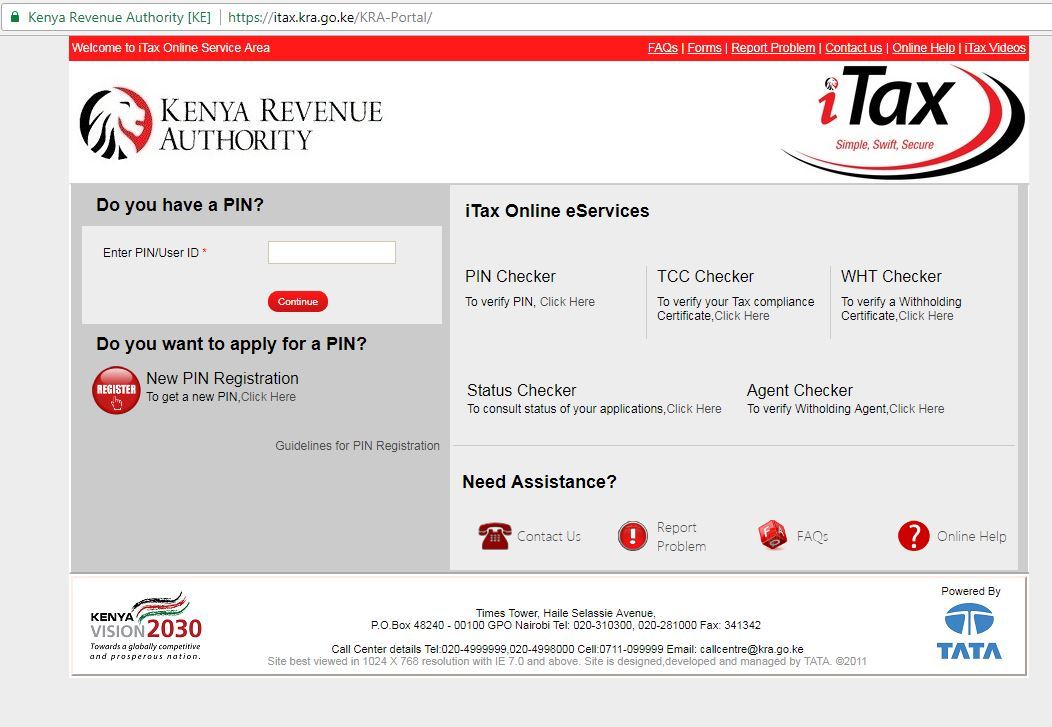

According to KRA, the 400, 000 people could have their Personal Identification Numbers (PIN) deactivated and pay deducted after the Kenya Revenue Authority sent notices to those who failed to file their tax returns by June 30.

The Taxman has now announced that individuals who failed to meet the deadline face a Sh2,000 fine or five per cent of the tax payable in the year under review, or whichever is higher.

“Please make payment of Sh2,000 within 15 days ending 30 July failure to which attracts collection enforcement measures,” KRA said in notices to some of those in breach.

The enforcement measures could include PIN deactivation, which blocks individuals from processing transactions that require an active number like salary and supplies payments.

The Tax Procedures Act of 2015 empowers KRA to order employers to deduct the penalties and tax dues from worker’s salary.

“Under subsection (2) requires an agent to deduct a specified amount from a payment of a salary, wages or other similar remuneration payable at fixed intervals to the taxpayer,” says the Act.

“The amount required to be deducted by an agent from each payment shall not exceed twenty per cent of the amount of each payment of salary, wages or other remuneration (after the payment of income tax).”

Companies face a penalty of Sh20,000 or five per cent of the tax payable in the year the return is meant to capture, or whichever is higher.

Filling tax returns has emerged as one of the taxman’s preferred way to netting tax cheats and growing the income tax segments amid struggles to meet collection targets. The law requires anyone with a PIN to file their annual returns irrespective of their employment status.

The taxman has failed to meet revenue targets in recent years on tax defaulters and a small tax bracket that fails to capture the self-employed and those working in the informal sector.

Official data shows that 2.9 million Kenyans worked in the formal sector last year compared to 14.8 million in the informal sector.