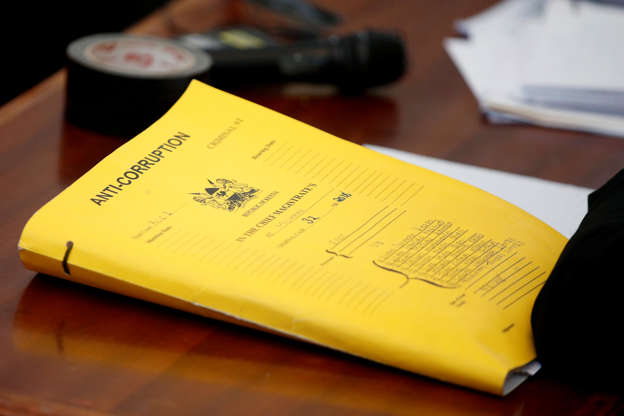

A former Finance Director at Kenya Reinsurance Corporation, Mr John Faustin Kinyua has been charged for tricking taxpayers into buying a house at Embakasi’s Villa Franca Estate for one Charles Gichane.

Kinyua is alleged to have used his office to allocate a house in Villa Franca Estate to Gichane. He faces an alternative charge of fraudulently disposing off the house belonging to Kenya Re.

Gichane has been charged with fraudulent acquisition of public property. The two are also jointly charged with obtaining registration by false pretence.

They allegedly procured the registration of Gichane as the titleholder of the land at Villa Franca where the ho

use is, by falsely pretending he had paid Sh3.2 million to Kenya Re.

John Faustin Kinyua convicted for abuse of office while Charles Gichane,was convicted for fraudulent acquisition of public property. Trial Magistrate Lawrence Mugambi sitting in Milimani Nairobi ordered them to serve 3 years in jail and one year in jail respectively in default.

— EACC (@EACCKenya) May 13, 2019

John Faustin Kinyua convicted for abuse of office while Charles Gichane,was convicted for fraudulent acquisition of public property. Trial Magistrate Lawrence Mugambi sitting in Milimani Nairobi ordered them to serve 3 years in jail and one year in jail respectively in default.

— EACC (@EACCKenya) May 13, 2019

Now, the duo could spend three years in jail if they each fail to pay a Sh7.3 million fine.

chief magistrate Lawrence Mugambi ruled that the two hatched and executed the scheme.

He ordered that each should pay Sh1 million for the fraudulent acquisition of public property, alongside a fine double the value of the house at the time of the crime.

In the scam, Kinyua engaged Gichane as a fake whistle-blower and consultant, whose ‘payment’ was used to purchase the house.

The two were initially tried between 2008 and 2014 but High Court judge Lydia Achode ordered a retrial owing to a hitch in their initial prosecution — the Ethics and Anti-Corruption Commission had not reported findings of its investigations to the Attorney-General before pursuing criminal charges against them.

The duo cost Kenya Re Sh3.196 million hence they were each ordered to pay Sh6.3 million. This brought the total fine to Sh7.3 million each.

Kinyua wrote to Gichane asking him to provide consultancy services for Kenya Re.

Gichane accepted the offer on the same day — April 28, 2000. Three months after the deal was signed, Gichane asked that part of his commissions be committed to buying the house. After all, Kenya Re had put the prime property up for sale.

On August 12, 2003, Kinyua wrote to Heritage Insurance demanding that the company settle premiums due to Kenya Re for the period between January and March, 1999.

One of the cheques Heritage issued to Kenya Re — number 026937 — for Sh3.196 million for fire insurance premiums would then get logged in as payment for Gichane’s consultancy services.

As Gichane wanted part of his payment to be used to purchase the house, Kinyua obliged.

Aside from the fact that a cheque from Heritage was being used to buy a house for Gichane, there was another problem with the dealings — Kenya Re’s board policy did not allow Kinyua to engage anyone as a whistle-blower or consultant.