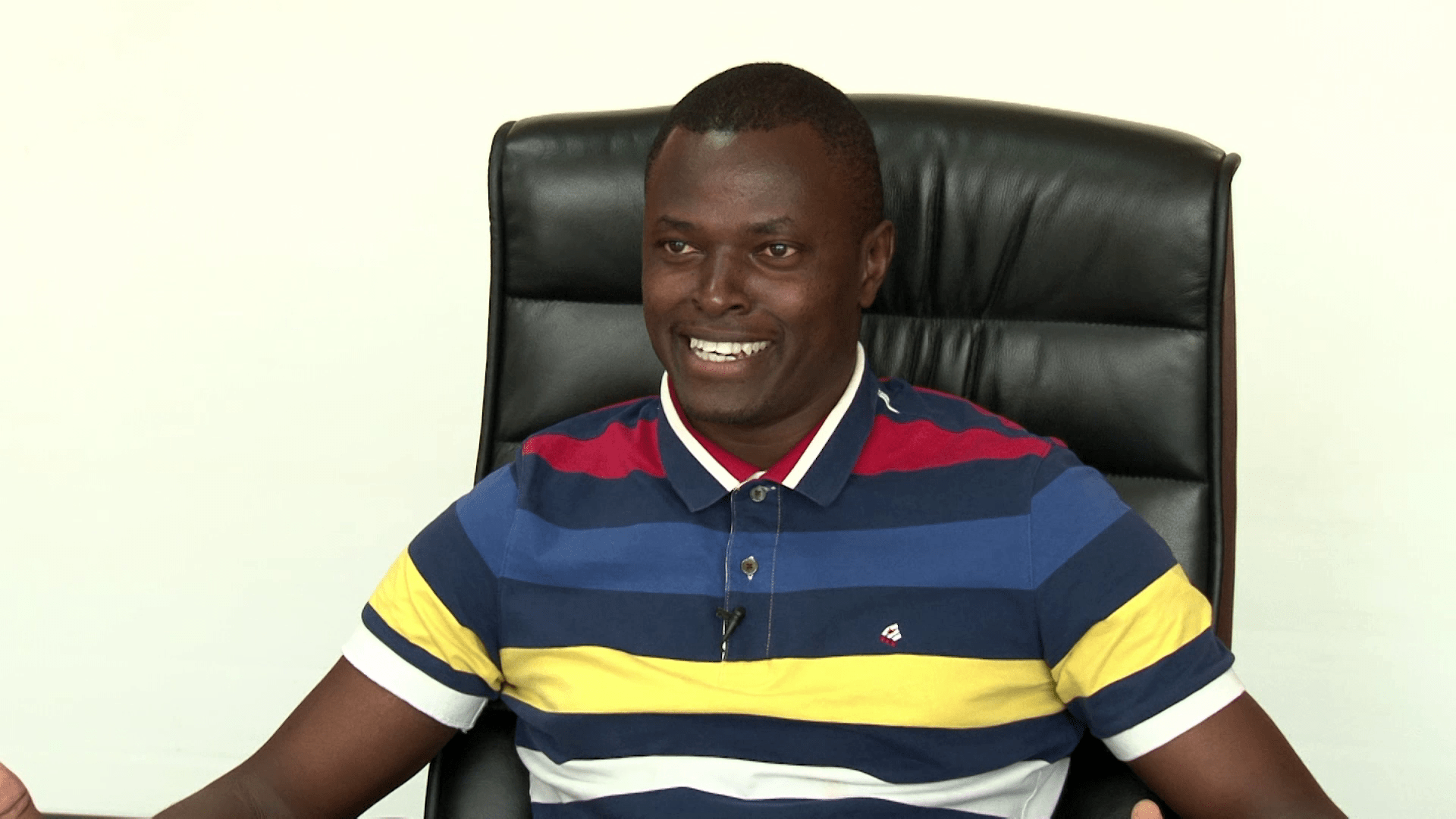

In the Political Arena, a mention of the name Ndindi Nyoro immediately invokes that of Deputy President William Ruto. The two have lately become friends with Ndindi Nyoro apparently willing to even take a bullet for Ruto just to ensure that the DP makes it to Statehouse come 2022.

He is young, vocal and rich.

Just how did he rise to the top?

Ndindi Nyoro is the co-founder of Investax Capital and the Member of Parliament for Kiharu constituency. His walk into success was cultivated through sweat and determination.

When you hear Ndindi Nyoro talking about stocks, you would imagine he has spent the better part of his life learning how to trade on the bourse. Not so. Nyoro, the director and co-founder of Investax Capital Ltd the largest stocks agent in Kenya under SBG Securities was the son of a carpenter. His mother would supplement his father’s earnings through farming.

What Nyoro lacked in affluence, he more than made up for it with passion for business. Living in Gathuki-ini Village, Kiharu Constituency in Murang’a county taught him a few business lessons. His desire to get out of poverty saw him start a rabbit and poultry-keeping project. In 1997 when he was in Class Six he sold some of the poultry to start a small shop inside his mothers’ house.

A month later the business picked up and he opted to open a kiosk outside their house, a decision his father did not like. This was also the first time he traded in stocks, although not in the literal sense. “When I started the shop, my aim was to drop out of school and when the business grew, I stopped going to school, but my father bought all my stock worth Sh1,000 and ordered me to go back to school,” he said.

Left with no option, Nyoro bought a goat with the proceeds and went back to school. In 1999 he joined Kiambugi High School and true to his nature found a way to make money by becoming a cobbler. In Form Three he started a charcoal business, which he operated during school holidays when he would shuffle between his business and his sister’s second hand stall in Thika Mukiriti market.

“I lost my father while in Form One and since my mother couldn’t manage to pay my school fees, my sister took that responsibility and I was working to supplement what she was getting. This exposure made me who I am today,” he said.

After high school in 2003, the school recruited him as a librarian for a salary of Sh3,000 so that he could clear pending school fees. After a year he had cleared his arrears and he was free to go. Life became unbearable in 2004 since he didn’t have any job and he relocated to Nairobi. He was forced to look for casual jobs in industrial area to survive.

In 2005 his life took a turn for the best when he was admitted at Kenyatta University to pursue a Bachelors of Arts degree in Economics. In his second semester he started a small hotel using money loaned to him by the Higher Education Loans Board (HELB).

In the Third semester his business collapsed after the then Vice Chancellor, Olive Mugendi, made reforms in the kitchen services that saw the price of food at the university mess drop drastically, making students opt to eat there. “This was really discouraging considering that the business was booming. I started soliciting money from politicians wso that I could vie as a student leader, but I didn’t get any position,” he says.

His first dealing with stocks was in 2006 when Ngenye Kariuki Stock Brokers employed him. The same year after gaining enough experience, he opened his agency, Stock Bridge Brokers under Dyer & Blair Investment Bank, a business he continued until he graduated.

In 2012 his stock broking business closed down and from his savings he decided to start Afrisec Telecoms Ltd, an Internet service dealer with Liquid Telecoms, despite the fact that he didn’t have a background in Information Technology.

Armed with Sh150,000 he approached Liquid Telecoms, formerly Kenya Data Networks (KDN) to get a dealership, but he was shocked to learn that he required at least Sh500,000 and two vehicles to get the deal. For two months he did his best to raise the money and he finally struck the deal.

Once Afrisec was steadily on its feet, he saw a budding opportunity in Investax Capital Ltd, a company based in Nairobi, which is owned by his former classmate at Kenyatta University. He invested Sh5 million into the firm and became an equal partner.

The company has opened two other branches in Naivasha and Nakuru. “Stock broking will forever remain my number one business because I have been in it for almost a decade now. It is a lucrative business and my future plans are to strengthen the company,” he said.

He adds that the two businesses, which are fully operational have birthed another company, Sahara Capital, an equity firm that has invested in energy, IT and finance sectors.